Building Control Survey results raise concerns over level of preparedness for new regulatory demands

In the run-up to the Building Safety Regulator’s (BSR) April deadline for registering as a building inspector, CABE conducted a survey of members to understand their concerns and gauge feelings of preparedness.

The following dates are well known to building control professionals; 28 April 2022: the new Building Safety Act became legally binding in England and with it the creation of BSR; October 2023: building control professionals must begin proving their competence in line with the Building Control Inspector Competency Framework; and 6 April 2024: the initial deadline given for all building inspectors to register with BSR in order to legally continue working. Registration requires proof of competence, or as later established, proof of intent to be determined competent via an applicable route. A new date emerged – 6 July 2024: the extension of the proof of competency deadline issued by BSR as it became apparent in spring that not all professionals would have completed their chosen competency schemes by 6 April.

It has been a turbulent time for the construction industry, to say the least. As of April 2024, 18% of CABE’s members work in the building control sector. As part of CABE’s continuous mission to engage with, and further understand, its members’ concerns, the Association conducted its second building control survey with members in England and Wales in January 2024. More than 400 members took part and the results have been shared with the Department of Levelling Up, Housing and Communities (DLUHC) and BSR.

The total number of respondents currently working in the sector remains in line with CABE’s 2022 survey (89% compared to 90% in 2022), although there has been a rise in the number working in local authority building control (50% vs 36%) and a fall in the number working as Approved Inspectors (39% vs 53%).

CABE Courses supporting building control

- Certificate in Building Control bit.ly/CABE-certificate-building-control

- Level 4 Diploma in Building Control Site Inspection & Plan Assessment bit.ly/CABE-diploma-package

- Future Homes Part L bit.ly/CABE-future-homes-part-L

- Plan Interpretation Workshop bit.ly/CABE-interpretation-workshops

- Basic Structural Design for Non-Structural Engineers bit.ly/CABE-basic-structural-design

- Webinar: Independent Warranty Support Integrity Testing bit.ly/CABE-independent-warranty-webinar

- Webinar: The Benefits of Natural Cement bit.ly/CABE-natural-cement-webinar

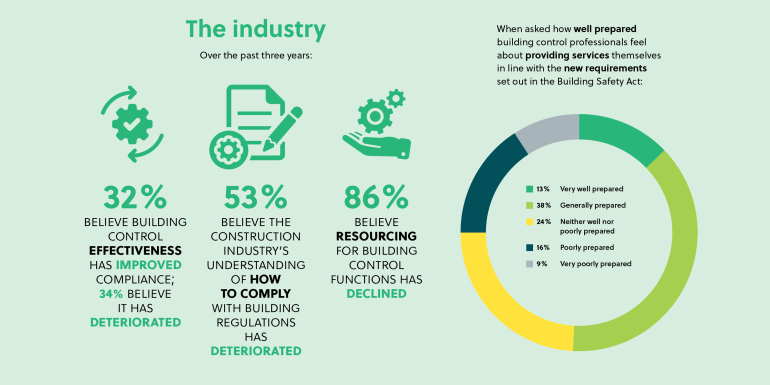

Perhaps unsurprisingly given the survey timings, job satisfaction scores are not at dizzy heights: professionals are feeling less content than in 2022 and more negative about the future of the industry (scoring 52 out of 100 for job satisfaction and 64 out of 100 about the future of the industry). The survey also highlights that resourcing for building control functions remains on the decline, with 86% of respondents agreeing with this notion compared with 82% in 2022. This may account for shifts in the percentages for career progression since the previous survey. The number of respondents who plan on continuing in building control over the next three years is down by 12% (to 41%), and those who plan to leave building control but stay in the construction industry is up by 8%. One positive is that the results showed negligible difference between numbers planning to retire and numbers planning to leave the industry entirely in comparison to 2022. In fact, 83% of respondents are intending to register as a building inspector, so at least there doesn’t seem to be a planned exodus being reflected.

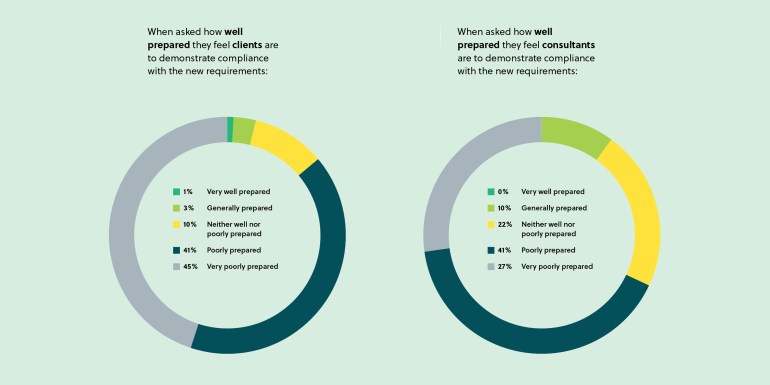

In terms of preparedness for operating in line with the new requirements as set out in the Building Safety Act 2022, it is good to see that over half of respondents feel they are ready to provide building control services (51%) under the new regime. But the majority still felt that their own clients and consultants collaborating on their project are poorly prepared (86% and 68% respectively). These figures show a worrying lack of confidence across the board and highlight a general concern that the impact of the changes has not filtered through the whole of the industry.

The theme continues, with 53% of respondents reporting that they believe the construction industry’s understanding of how to comply with building regulations has deteriorated over the past three years.

To bolster faith and boost confidence across the profession, it is arguably more important than ever for professionals to feel supported by their employer. Luckily, 65% of respondents feel just that. It is encouraging to see that almost three-quarters have their professional membership paid for in full, or in part, by their employer (73%). An even larger number have employers that contribute to their professional development (85%).

Neither percentage has dipped significantly in recent years and neither has the number of people being given time off by employers for professional development (69%).

View the results in full at cbuilde.com/page/BCS2024